- Productize

- Posts

- Thoughts on Agency Cashflow

Thoughts on Agency Cashflow

Something that was on my mind the last month that I thought it would be fitting to talk about is Cashflow–the vital lifeblood for your Productized Agency or Consultancy.

With it, you thrive. Without it, your business dies.

Here’s a quick & easy Cashflow 101 for you to consider, digest, and implement into your business.

1. First, What the heck is Cashflow?

Simply put, Cashflow = the money left over after paying for everything else.

For example, you offer email copywriting as a service.

You charge $100 per email - Cost of Goods Sold (COGS) of $50 to your writer, you then have a nice $50 Gross Profit.

Your costs were $50

Your Cashflow was $50

Your Gross Profit was 50%

Gross Profit = the profit left over after any cost directly associated with the delivery of your service has been removed.

Net Profit = any additional indirect operating expense your business incurs to deliver your service after COGS. Think software, assistant, project managers, etc.

I recommend shooting for 30-40% COGS max which will give you a 60-70% Gross Profit Margin. This is a great place to be.

It’s common to back yourself into a corner when you start offering a new service with a low gross profit margin of less than 50%. You won’t be able to scale or hire anyone as you grow because there isn’t enough juice left to squeeze. Always think, “What would I need to charge in order to have a team execute and deliver this work?”

Even if you do everything yourself initially, at least you will have this concept baked in for when you’re ready to expand your team.

2. Cashflow Types

Cashflowing assets are the dream.

Your service business will soon be one of these assets (if it isn’t already) as we work together to further disconnect your time input within the business. It will also fuel the “monopoly” collection of future assets.

There are two types of cashflow to keep top of mind:

Active Cashflow = trading time for money

This is the most common type of cashflow, and it is very important. Try to limit active cashflow over time, as passive cashflow grows. But you should never turn off the faucet completely.

Passive Cashflow = Assets producing Cashflow without your direct time involvement

Positive Cashflow from your Productized Service business is one of many sources, or “income pumps,” that will fuel your ability to live your dream lifestyle, collect more assets, and/or reinvest into your machine to grow faster/bigger.

Again, all fueled by Positive Cashflow.

Stay Positive. Keep Stacking.

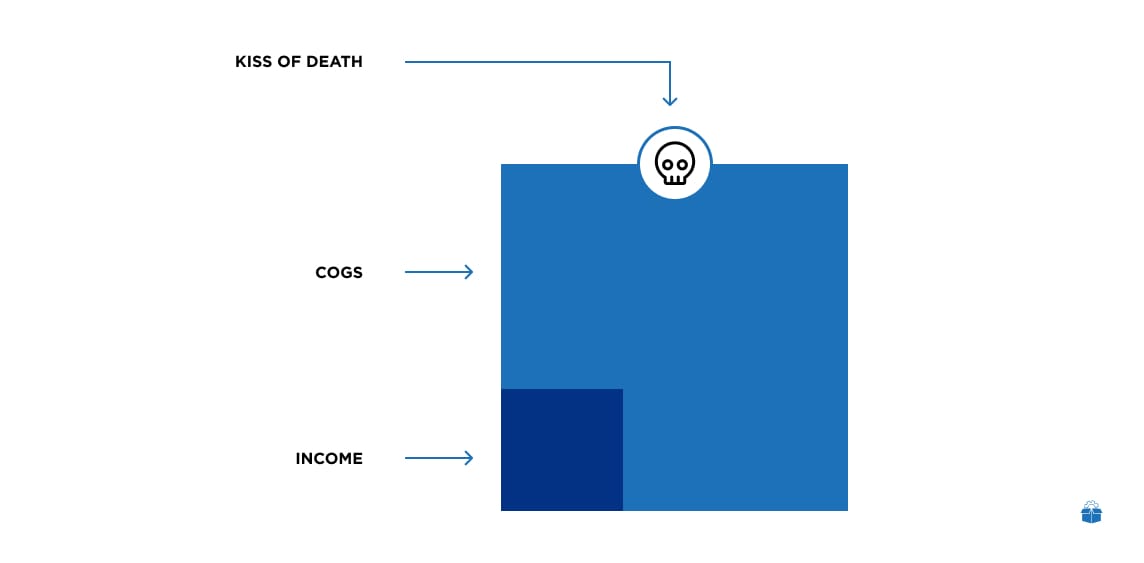

3. Negative Cashflow

This is when your expenses or COGS exceed your income.

This is what we call the Kiss of Death. Avoid this.

Know your numbers and look at them daily. Keep a healthy gross profit margin of ideally 60%+

The key is avoiding liquidating assets because of a lack of cashflow. This moves you backward and kills compounding momentum.

If you are facing negative cashflow right now, look at these 9 quick cashflow revitalization methods:

Ensure you’re collecting all cash up front rather than spreading out payments.

Eliminate accounts receivables completely.

Move all your team payouts to a monthly payout. This will allow you to keep cash longer. Stretch out your payables.

Set up a system to forecast and track cashflow better. Ideally, aim for a rolling 13-week cashflow cycle.

Consider leveraging a business credit card to allow yourself to keep cash on hand longer.

Audit & Reduce expenses - focus on cutting things that aren’t directly related to revenue generators.

Ensure your Gross Profit margin is healthy and above 60%.

Audit your pricing and see if you have opportunities to increase.

Audit your COGS and see if you have opportunities to decrease.

4. Cashflow Stacking

Your ability to produce an “abundance” of cashflow will serve you well and fuel your ability to stack more assets that also produce cashflow–which is the real game we should all be playing.

The goal is to have your passive cashflow ratio increase while your active cashflow decreases over time.

Again, active income is really important.

In my opinion, it should never be turned off. It fuels everything else + keeps you sharp within your “thing” or “expertise.”

Work to optimize your active “activities” that are fun, rewarding, and provide value.

Excess cash flow can then be carved out and allocated in a few ways:

Invest in yourself, your team, and your business (most ideal until you pass $1MM ARR).

Take as-profit distributions.

Invest in new, higher-leverage product offerings within your business.

Invest in other cash-producing assets that ideally vertically integrate into your core service offering.

Adam from Freshly Squeezed runs a Productized SEO writing service and has been fortunate enough to stack a little money on the side because he has implemented strong cashflow strategies and margins.

He is actively looking to increase the asset value of his business by vertically acquiring other SEO companies, small blogs, or communities that are within his niche vertically. Strategic acquisitions can be great “bolt-on” acquisition targets as you look to funnel excess cashflow in productive directions.

5. Invert your Thinking

Your Cashflow is actually the premium a customer pays to use your service compared to doing it themselves.

Cashflow & premium are actually the same things.

Thus, 50% Cashflow is actually a 50% premium.

The same can be applied to your sales. If your close win rate is 20%, that means you are actually also losing 80% of your meetings.

This change of perspective can be valuable, sobering, and helpful in rethinking how you solve problems.

As well, shed light on how your customers look and interrupt the value you’re offering.

6. Hours vs Assets

Trading hours = current cashflow. It’s a surplus of what you do.

Building Assets = Future cashflow. It’s a surplus of what you own.

My goal is to help you optimize your current cashflow and allocate as much excess as possible into future cashflow/assets.

Your goal should be to build a valuable service business that could be something investors are fighting over to buy, even if you never actually want to sell it. I’ll cover more on optimizing exit value in our upcoming memos.

A productized asset provides you with true optionality.

7. Cashflow & COGS

Let’s talk about COGS, or your “cost of goods sold.”

This is a vital element within all productized service businesses. A lot of people mess this up.

If you don’t follow a profit-first financial framework for your business, I would highly recommend it.

Reference this masterclass I did with Michael Werk of Bean Ninjas who goes deep into the process. Also, grab the book on Profit First here. (Well worth reading and implementing).

COGS will be one element that is vital to understand.

When you sell your product for $100 you will have a cost to fulfill it. That raw cost is what we call your COGS.

This should be fixed and predictable on your end.

COGS will be anything directly associated with the delivery of your service. Nothing else. To keep it simple, within our email copywriting example you charge $100, and you pay a copywriter $50. Your gross profit is $50, and your COGS = $50.

What you will want to do is create a “COGS” account at your bank. This is a separate sub-account.

This account is where you will pay your team and anyone that is directly involved in executing your “thing”.

This becomes especially important when you start selling multiple units of your thing or selling quarterly or even yearly packages where customers are then paying you upfront.

Mixing COGS and OPEX monies should be avoided.

This will help you manage your cashflow and set aside your COGS for when they are executed. Keeping this separate will help bring clarity + organization to your finances.

Systems = consistency.

8. 4 Types of Cashflow Leverage

1. Financial leverage = Getting things you did not pay for

2. Operational leverage = Ability to create output that isn’t bottlenecked by your input

3. Distribution leverage = Accessing audiences you didn’t build where your customers are

4. Time leverage = Multiplying and increasing your fixed time by working less

“A unit of time invested into learning how to maximize your time is 10X more powerful than simply trying to work harder or faster with the same time”

- -

Tyler

Reply